Monday, 30 December 2013

Monday, 2 December 2013

Saturday, 30 November 2013

Friday, 18 October 2013

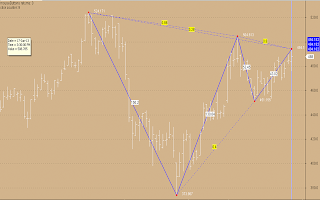

Gartley Tools

Plot( C, "", colorWhite, styleBar, 0, 0, 0 );

_SECTION_BEGIN("Gartley Tool");

Gartley=ParamToggle("Gartley","OFF|ON",1);

Type=ParamToggle("Label","ABCD|PRICE",1);

Snap=ParamToggle("Snap","Yes|No",1);

if(Gartley==1)

{

SetBarsRequired( -2, -2 );

bi = BarIndex();

bis = SelectedValue( bi );

symbol = Name();

tframe = Interval();

chartID = GetChartID();

Xname = "X" + chartID + symbol + tframe;

Yname = "Y" + chartID + symbol + tframe;

LeftButton = GetCursorMouseButtons() & 1;

a = Nz(StaticVarGet("counter"));

if ( leftButton )

{

StaticVarSet("counter", a+1);

x = GetCursorXPosition( );

y = GetCursorYPosition( );

StaticVarSet( Xname + bis, x );

StaticVarSet( Yname + bis, y );

}

j = 0;

dt = DateTime();

shapePlot = 0;

shapePos = Null;

xx = yy = Null;

for ( i = 0; i <BarCount; i++ )

{

x = StaticVarGet( Xname + i );

y = StaticVarGet( Yname + i );

if ( x == dt[i] AND snap==0)

{

shapePlot[i] = 1;

shapePos[i] = IIf(abs(H[i]-y) < abs(L[i]-y), H[i], L[i]);

xx[j] = i;

yy[j] = IIf(abs(H[i]-y) < abs(L[i]-y), H[i], L[i]);

j++;

}

else if ( x == dt[i] AND snap==1)

{

shapePlot[i] = 1;

shapePos[i] = y;

xx[j] = i;

yy[j] = y;

j++;

}

}

shape = shapeSmallCircle;

PlotShapes( shapePlot*shape, colorRed, 0, shapePos, 0 );

Values=ParamToggle("Segment Values","No|Yes",1);

vr=ParamToggle("R1","No|Yes",1);

vr2=ParamToggle("R2","No|Yes",0);

vr3=ParamToggle("R3","No|Yes",1);

for ( i = 1; i <= j ; i++ )

{

if(i==1 AND Type==0)

{

PlotText("X ",xx[i-1]-2,yy[i-1],colorWhite);

}

if(i==2 AND Type==0)

{

PlotText("A ",xx[i-1]-2,yy[i-1],colorWhite);

}

if(i==3 AND Type==0)

{

PlotText("B ",xx[i-1]-2,yy[i-1],colorWhite);

}

if(i==4 AND Type==0)

{

PlotText("C ",xx[i-1]+2,yy[i-1],colorWhite);

}

if(i==5 AND Type==0)

{

PlotText("D ",xx[i-1]+2,yy[i-1],colorWhite);

}

if(i==6 AND Type==0)

{

PlotText("E ",xx[i-1]+2,yy[i-1],colorWhite);

}

if(i==7 AND Type==0)

{

PlotText("F ",xx[i-1]+2,yy[i-1],colorWhite);

}

if(i==8 AND Type==0)

{

PlotText("G ",xx[i-1]+2,yy[i-1],colorWhite);

}

if(Type==1)

{

PlotText(""+yy[i-1],xx[i-1]+2,yy[i-1],colorWhite);

}

Plot( LineArray( xx[i-1], yy[i-1], xx[i], yy[i] ), "", colorBlue, styleThick );

XA=yy[i]-yy[i-1];

AB=yy[i]-yy[i+1];

BC=yy[i+1]-yy[i+2];

CD=yy[i+2]-yy[i+3];

r=CD/XA;

r2=AB/XA;

r3=XA/BC;

if(vr==1)

{

PlotText(""+Prec(abs(r2), 2 ),XX[i-1]+int((xx[i+1]-XX[i-1])/2),yy[i-1]+((yy[i+1]-yy[i-1])/2),colorBlack,colorYellow);

Plot( LineArray( xx[i-1], yy[i-1], xx[i+1], yy[i+1] ), "", colorBlue, styleDashed );

}

if(vr2==1)

{

PlotText(""+Prec(abs(r3), 2 ),XX[i-1]+int((xx[i+2]-XX[i-1])/2),yy[i-1]+((yy[i+2]-yy[i-1])/2),colorBlack,colorYellow);

Plot( LineArray( xx[i-1], yy[i-1], xx[i+2], yy[i+2] ), "", colorBlue, styleDashed );

}

if(vr3==1)

{

PlotText(""+Prec(abs(r), 2 ),XX[i-1]+int((xx[i+3]-XX[i-1])/2),yy[i-1]+((yy[i+3]-yy[i-1])/2),colorBlack,colorYellow);

Plot( LineArray( xx[i-1], yy[i-1], xx[i+3], yy[i+3] ), "", colorBlue, styleDashed );

}

if(Values==1)

{

PlotText(""+Prec(abs(XA), 2 ),XX[i-1]+int((xx[i]-xx[i-1])/2),yy[i-1]+XA/2,colorBlack,colorWhite);

}

}

if ( GetCursorMouseButtons() == 12 )

{

for ( i = 0; i < BarCount; i++ )

{

StaticVarRemove("counter");

StaticVarRemove( Xname + i );

StaticVarRemove( Yname + i );

RequestTimedRefresh(1,True );

}

}

Title = "mouseButtons returns: " + (GetCursorMouseButtons()) + "\nclick counter: " + StaticVarGet("counter");

}

_SECTION_END();

Monday, 30 September 2013

Monday, 23 September 2013

Saturday, 7 September 2013

Friday, 23 August 2013

Friday, 26 July 2013

Multiple Time Frames

Robert Krausz's Multiple Time Frames

"Although multiple time frame techniques have become more visible, the most robust approach has been taken by Robert Krausz. To understand the importance of first arriving at a sound theory before implementing and testing a trading program, we need to briefly review the characteristics of performance that indicate a robust method.When testing a trend-following system, we should expect that a trend of 100 days, compared with a trend of 50 days, will produce greater consistency, greater reliability, and proportionally fewer trades.

As you increase the calculation period, this pattern continues; when you reduce the calculation period this pattern reverses. You are prevented from using very short calculation intervals because slippage and commissions become too large; the longest periods are undesirable because of large equity swings.

There must be a clear, profitable pattern when plotting returns per trade versus the average holding period.The sophistication in Krausz's work lies in his understanding of this pattern, and its incorporation into the structure of his program, The Fibonacci Trader. Krausz works in three time frames rather than two. Each time frame has a logical purpose and is said to be modeled after Gann's concept that the markets are essentially geometric.

The shortest time frame is the one in which you will trade, in addition, there are two longer time frames to put each one into proper perspective.The patterns common to time frames are easily compared with fractals; within each time frame is another time frame with very similar patterns, reacting in much the same way.

You cannot have an hourly chart without a 15-minute chart, because the longer time period is composed of shorter periods; and, if the geometry holds, then characteristics that work in one time frame, such as support and resistance, should work in shorter and longer time frames. Within each time frame there are unique levels of support and resistance; when they converge, increasing stability. In Krausz's work, the relationships between price levels and profit targets are woven with Fibonacci ratios and the principles of Gann.

One primary advantage of using multiple time frames is that you can see a pattern develop sooner. A trend that appears on a weekly chart could have been seen first on the daily chart. The same logic follows for other chart formations.

Similarly, the application of patterns, such as support and resistance, is the same within each time frame. When a support line appears at about the same level in hourly, daily, and weekly charts, it gains importance.

As a well know trader, Krausz brings more than just three time frames and some unique strategies to the display screen. He endows the program with six rules:

As you increase the calculation period, this pattern continues; when you reduce the calculation period this pattern reverses. You are prevented from using very short calculation intervals because slippage and commissions become too large; the longest periods are undesirable because of large equity swings.

There must be a clear, profitable pattern when plotting returns per trade versus the average holding period.The sophistication in Krausz's work lies in his understanding of this pattern, and its incorporation into the structure of his program, The Fibonacci Trader. Krausz works in three time frames rather than two. Each time frame has a logical purpose and is said to be modeled after Gann's concept that the markets are essentially geometric.

The shortest time frame is the one in which you will trade, in addition, there are two longer time frames to put each one into proper perspective.The patterns common to time frames are easily compared with fractals; within each time frame is another time frame with very similar patterns, reacting in much the same way.

You cannot have an hourly chart without a 15-minute chart, because the longer time period is composed of shorter periods; and, if the geometry holds, then characteristics that work in one time frame, such as support and resistance, should work in shorter and longer time frames. Within each time frame there are unique levels of support and resistance; when they converge, increasing stability. In Krausz's work, the relationships between price levels and profit targets are woven with Fibonacci ratios and the principles of Gann.

One primary advantage of using multiple time frames is that you can see a pattern develop sooner. A trend that appears on a weekly chart could have been seen first on the daily chart. The same logic follows for other chart formations.

Similarly, the application of patterns, such as support and resistance, is the same within each time frame. When a support line appears at about the same level in hourly, daily, and weekly charts, it gains importance.

As a well know trader, Krausz brings more than just three time frames and some unique strategies to the display screen. He endows the program with six rules:

LAWS OF MULTIPLE TIME FRAMES

2. The higher time frames overrule the lower time frames.

3. Prices in the lower time frame structure tend to respect the energy points of the higher time frame structure.

4. The energy points of support/resistance created by the higher time frame's vibration (prices) can be validated by the action of lower time periods.

5. The trend created by the next time period enables us to define the tradable trend.

6. What appears to be chaos in one time period can be order in another time period.

Monday, 15 July 2013

Data Downloader

http://www.4shared.com/rar/HIqMkVCQce/Data_Downloader_with_password.html

This zip file is now password protected.

Please subscribe and leave a comment with mail id for receiving this Free NSE 1 Min and 5 Min Intraday Data and EOD Data Down loader.

For Historical NSE 5 Min Data visit :

http://prasadbrao.blogspot.in/p/intraday-data.html

UTRRC Downloader

Removed the link - You can download the data directly in ASCII format.